This is the Economic Rapture. The faithful are being called up to economic Heaven. The rest of us poor saps will rot in everlasting damnation.On Friday, November 21st, Citigroup stock closed at less than $4 per share.

Today, the US government announced that it would effectively guarantee Citigroup a per share price of about $10.

Wow! The government won't guarantee American workers a wage of $8 per hour. As of July 2009, if you have a job, you must be paid $7.25 per hour. If you work 40 hours per week, or 1080 hours per year, $7,830 per year.

But the government does not guarantee you a job! The government gives you a very modest amount for a limited time

if and only if you qualify for unemployment. You may also qualify for food stamps and for housing. So the government may help you achieve

mere survival if you qualify.

And for years now, the Official Dogma has been to tighten qualifications on the thesis that doing so — instituting a stick approach — will get people moving, will force us lazy-ass Americans to find work. (Never mind that they may just not be work.)

What is the qualification for a bloated financial institution getting federal assistance? Fucking up! The bigger Citigroup or Goldman Sachs or AIG fucked up, the more money the government gives them — exactly the opposite of the line they take with us.

What's the difference? Well, friends of feds run those institutions. Buddies who went to Harvard, Yale, Chicago. Friends from college, business school. Friends who were colleagues at Goldman or Citi.

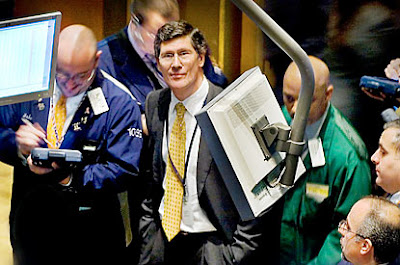

This past weekend, guru Robert Rubin was busy meeting with federal officials. Current Citi head was meeting.

When was the last time any Bush figure — or for that matter, any Obama figure — met with a labor leader?For months I have been saying that this is an economic downturn with an essential difference — the wealthiest Americans, the creditors, the Rentier class — is at risk. In past downturns, when regular folks — you and me — were at risk, who cared? "Let us eat cake."

But Bush and Paulson, or Obama and Geithner, can't let their peers suffer. And make no mistake, even if Obama came up from nothing, he ain't there any more. Stop kidding yourselves, folks. Check out who Larry Summers, Timothy Geithner hang out with. It ain't production line workers.

If the automanufactures get a bailout from Obama, will they be required to refrain from laying off workers? Will they be required to keep jobs in the US?

No requirement has yet been imposed on financial institutions to loan to regular debtors. The British did impose such a requirement, so it can be done. But not in the US.

This will come back to haunt them. Even if We the People don't wake up, as we did in the lead-up to the first round of bailouts (before the media and the elite closed ranks), we must be able to buy stuff.

Bush may have sounded like the craven idiot he is when, after 9/11, he urged us to go out and buy stuff. BUT all he was doing was saying what the Wall Street brigade was thinking. Now they are saying it more explicitly. That's the whole damn point of (supposedly) injecting 'liquidity' into the economy.

But if it doesn't work, and we lose our ability even to buy the food and water we need to live, somebody wiser than our leaders will step in. Watch for China, or some other Asian giant, to formulate its version of the Marshall Plan . . . for us. At the moment, we are still the world's leading buyers, consumers, wasters.

Of course, we needn't be. The US comprises less than 5% of the Earth's human population. Five percent can go by the board with the world's economy still doing quite well. After all, for decades here in the US, 3% or 4% unemployment has been called "full employment". (How's that for Newspeak?)

So if China, India, Korea and others can find other, more flexible recipients of aid, perhaps they'll give up on the US.

_______________

AN ASIDEMonday, November 24, Citigroup saw its stock soar, increasing in value by almost 60%. How many of the insiders, do you suppose, took advantage of their advance knowledge? In the chaos of the Rapture, given the Bush hostility to regulation and oversight (as opposed to just plain spying on just plain folks), how much inspection will there be of trades by the Rubins or Geithners or Paulsons?